By definition, arbitrage is the discovery of price differences on the same asset in different venues to gain a "risk free" profit - this is possible since markets are not always perfectly efficient. In arbitrage trading, one would sell the asset that is priced higher in one market, while buying that same asset in another market where it’s priced lower. The profit earned is the difference between the prices in the two markets.

Cross Market Arbitrage

Cross markets arbitrage is commonly used in the cryptocurrency space since it is a global asset. For example, let's assume that the price of Bitcoin (BTC) is $18,000 on Binance and $18,600 on Injective's DEX. In theory, you could buy 1 BTC on Binance and then sell it on Injective's DEX, for a profit of $600.

Below are two possible circumstances with respect to crypto arbitrage:

Scenario One: Temporary Price Mismatch

Sometimes the asset price is higher on Injective's DEX, and sometimes the same asset is priced lower compared to the prices on other exchanges, such as Binance or Coinbase.

In this situation, you need to split your money into two parts. For example, you let's assume you use 1 BTC + $20,000 USDT. You would then put 1 BTC in Binance and deposit $20,000 USDT into Injective.

If the BTC price is lower on Injective, you would buy 1 BTC with USDT on Injective and sell 1 BTC on Binance. You would then wait until the BTC price increases on Injective to sell out of your position and buy on Binance.

Scenario Two: Continuous Price Mismatch

If the asset price is always higher/lower on Injective compared to the price on other exchanges, implementing the aforementioned arbitrage strategy becomes more complex.

You still need to split your money in two, so 1 BTC + $20,000 USDT. You would put 1 BTC in Binance and $20,000 USDT in Injective. If the BTC price on Injective is higher (assume $19,800 USDT) and the price on Binance is lower (assume $19,000 USDT) you would then sell on Injective and buy on Binance. You would then wait until the price difference decreases to less than $800 USD-so $19,600 USDT on Injective and $19,500 on Binance for example-then buy on Injective and sell on Binance. While, the latter trade will lose you $100 USDT, you’ll still earn $700 USDT when both trades are taken into account.

Funding Rate Arbitrage

A key feature of futures is their expiration date. When a contract expires, settlement follows. Normally, traditional futures contracts are settled at monthly or quarterly intervals.

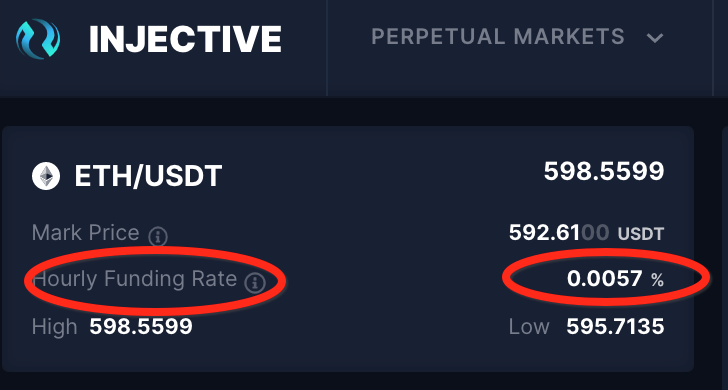

Perpetual swap contracts are widely offered by crypto exchanges without an expiration date. Since perpetual swaps will never be settled in a traditional manner, exchanges need a mechanism to ensure that the contract price converges on spot index prices. This mechanism is also known as the funding rate.

Funding rates are periodic payments to traders who have long or short positions, according to the difference between the contract price and spot index price. If the funding rate is positive (i.e. the contract price is higher than the index price), traders who have short positions are funded by traders who have long positions. If it’s a negative funding rate, the reverse situation occurs.

Normally the Injective funding rate is calculated once every hour. If the contract price is trading at a premium relative to the spot price, you could sell on Injective and buy from the spot market in order to receive a funding rate rebate. You could close your position on Injective and sell on the spot market when the contract price is trading at a discount relative to the spot price. In this way, you can profit from a funding rate arbitrage.

Triangular Arbitrage

Triangular arbitrage is possible when there exists a price discrepancy among three discrete trading pairs. These opportunities are rare and require traders to use trading algorithms in order to automate the process. This is needed because bots will usually detect such discrepancies and execute trades before a trader is manually able to do so.

For example, let's assume we have INJ-USDT, ETH-USDT, and INJ-ETH trading pairs. Let's also assume that the current price is 1 INJ = 10 USDT, ETH = 500 USDT, and INJ = 0.04 ETH. We can then take part in a triangular arbitrage strategy as follows:

We trade 1 ETH for 500 USDT in the ETH-USDT pair, we then trade 500 USDT for 50 INJ in INJ-USDT pair, and finally we can trade 50 INJ for 2 ETH in the INJ-ETH pair we can get 2 ETH. The result is a net profit of 1 ETH.

Arbitrage Risks

Arbitrage trading is considered relatively low-risk, but the associated risk is never zero.

The first major risk is liquidity. No matter what kind of arbitrage you’re engaged in, high levels of liquidity in these markets is an absolute must. If one of the markets lack sufficient liquidity, you will not be able to sell an asset on time, which can lead to a potential loss.

Liquidation risk is also possible, especially if you're trading derivatives on leverage.

Execution risk is another key hazard, which occurs when the difference between the bid and ask price is relatively close. Since exchanges always charge trading fees, if the spread is very small or if there’s a sudden spike in volatility, it could result in zero or even negative returns.

Concluding Remarks

Arbitrage trading is often a sound strategy in the crypto space, especially for traders who are opposed to taking on high levels of risk by holding an asset long term. If you have the proper skills and technical algorithms in place, these strategies can lead to considerable rewards with relatively low risk.

About Injective

Injective is a lightning fast interoperable layer one blockchain optimized for building the premier Web3 finance applications. Injective provides developers with powerful plug-and-play modules for creating unmatched dApps. INJ is the native asset that powers Injective and its rapidly growing ecosystem. Injective is incubated by Binance and is backed by prominent investors such as Jump Crypto, Pantera and Mark Cuban.

Website | Telegram | Discord | Blog | Twitter | Youtube | Facebook | LinkedIn | Reddit | Instagram | Orbit Newsletter