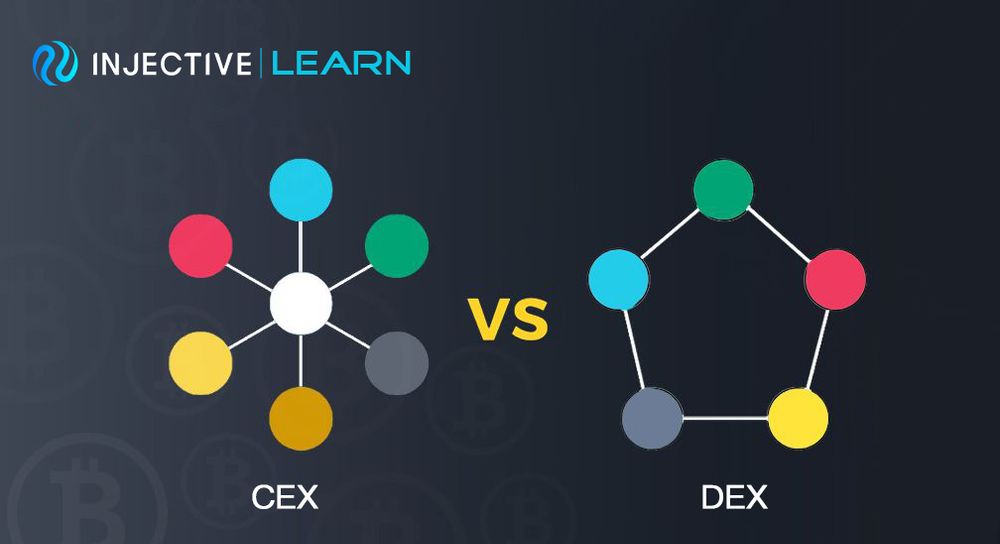

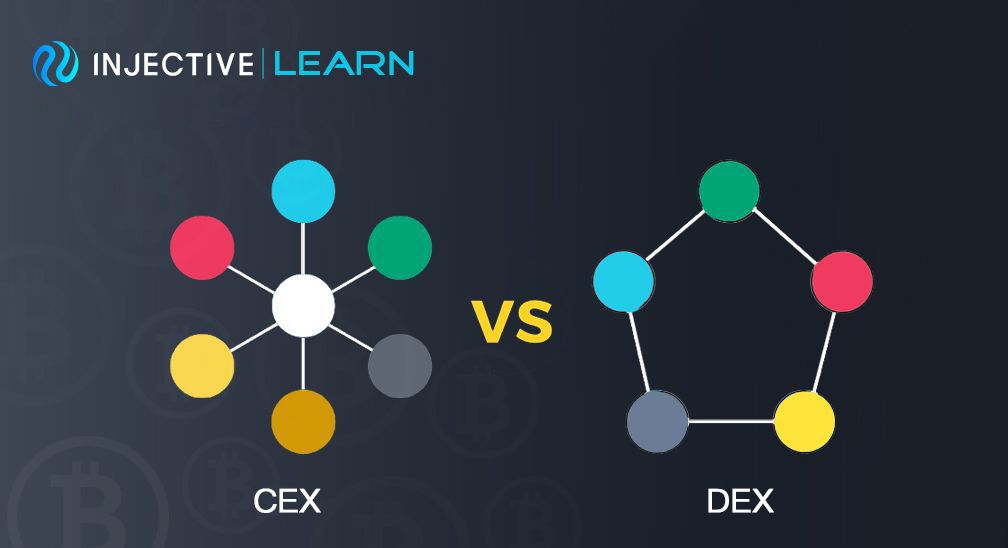

In this quick and easy guide, we will break down the key highlights and differences between centralized exchanges (CEXs) and decentralized exchanges (DEXs).

Centralized Exchange (CEX)

Centralized cryptocurrency exchanges are online platforms used to trade cryptocurrencies. Since they are completely centralized, they act as a custodian over your funds and control your private keys.

For a long time, CEXs have been the go-to place for traditional investors, as these exchanges have offered them a similar experience to traditional brokerage firms and exchanges. Centralized exchanges have also provided necessary trading features such as trading on margin and opening short positions. Likewise, traders who are new to crypto have often opted to use CEXs, trusting the middleman to hold their funds.

CEXs often have superior UI/UX relative to their DEX counterparts, which leads to a much more intuitive experience for both retail and institutional traders alike. However, for those who truly believe in the advantages of decentralization find CEXs to be subpar in many respects.

Over the past ten years, hackers have stolen more than $1 billion worth of crypto from CEXs. Though CEXs like Binance have been able to reimburse traders from their own reserve at times, users' credentials were still put at risk. Moreover, due to government investigations and interventions, CEX users have had instances where their assets were frozen. In addition, CEXs often include rigorous KYC/AML policies that prevent users from certain regions and nations from gaining access to the trading platform.

Examples of CEXs

Here we provide a brief overview of the CEX ecosystem.

Binance

Binance is a centralized exchange that seeks to cater to all levels of investors by providing both basic and advanced trade setups. Through Binance traders can participate in trading competitions and earn while creating liquidity for tokens.

Coinbase

Coinbase is one of the most popular cryptocurrency exchanges in the industry. One of the main reasons for this is that they provide a convenience avenue for first-time users to purchase Bitcoin with PayPal, debit/credit cards, and bank transfers. The platform currently supports a number of major cryptocurrencies, including Bitcoin and Ethereum.

Gemini

Gemini is a global digital asset exchange and regulated New York trust company founded by Cameron and Tyler Winklevoss in 2015. Both crypto-to-crypto and fiat-to-crypto pairs are traded on the exchange. Since its inception, the exchange has introduced new crypto products to make crypto more accessible.

Decentralized Exchanges (DEXs)

A decentralized exchange (DEX) is a cryptocurrency exchange which operates in a decentralized manner without any form of central authority. DEXs do not require a third party to store your funds and enable you to retain control over your private keys at all times.

Since DEX transactions are peer-to-peer (P2P), they offer greater levels of transparency as well. Over the years, DEXs have grown immensely in terms of popularity. Crypto enthusiasts normally prefer DEXs in order to retain control and because they enable them to interact with decentralized finance (DeFi) products.

Examples of DEXs

Here we provide a brief overview of the DEX ecosystem.

Injective Protocol

Injective Protocol is the first layer-2 decentralized exchange protocol that unlocks the full potential of decentralized derivatives and borderless DeFi. Injective enables fully decentralized trading without any restrictions, allowing individuals to trade on any derivative market with zero gas fees and fast transactions.

Binance DEX

The Binance DEX runs on its own blockchain, Binance Smart Chain (BSC). The Binance DEX often has high liquidity, which has been the main weakness of other DEXs. The DEX will remain crypto-to-crypto and thus outside the purview of regulators.

Uniswap

Uniswap is a protocol built on Ethereum for swapping ERC20 tokens without the need for buyers and sellers to create demand. It does this via an Automated Market Making (AMM) model which sets an equation that automatically sets and balances the value depending on how much demand there exists in the market.

Conclusion

As explored in this guide, both CEXs and DEXs have their own merits.

The Injective community has been working to build a platform that integrates the best features from both the CEX and DEX ecosystems. On Injective traders will now be able to have security, anonymity, liquidity, and a superior UX all within one exchange.

About Injective

Injective is a lightning fast interoperable layer one blockchain optimized for building the premier Web3 finance applications. Injective provides developers with powerful plug-and-play modules for creating unmatched dApps. INJ is the native asset that powers Injective and its rapidly growing ecosystem. Injective is incubated by Binance and is backed by prominent investors such as Jump Crypto, Pantera and Mark Cuban.

Website | Telegram | Discord | Blog | Twitter | Youtube | Facebook | LinkedIn | Reddit | Instagram | Orbit Newsletter