Perpetual swaps have quickly become one of the most popular ways to trade cryptocurrencies over the past few years. It can most easily be thought of as a futures contract with no expiry date.

Before learning about the details of a perpetual swap, we need to first understand traditional future contracts first.

A futures contract is a legal arrangement to purchase or sell a specific commodity asset or security at a fixed price at a specified time in the future. Future contracts are standardized for quality and quantity in order to facilitate the trading of futures exchanges. When trading occurs, buyers and sellers are actually trading a contract, not an asset. The time period for delivering contract assets is called the settlement time.

Normally the contract trading price is different from the current spot price in the marketplace. The further away the settlement time is from trading, the further away the trading price typically is from the market's current spot price. This is due to the uncertainty over time-gap.

The perpetual swap is a new type of financial derivative. It allows you buy or sell the value of the underlying asset with several advantages:

- There is no expiry date to settle

- The underlying asset itself is never traded

- The perpetual swap is easy to short, and it enables leveraged trading

"No expiry date to settle" means that you don't need to worry about dealing with settlement issues. You can hold your position for a long time, similar to trading in a spot market.

If you are trying to hedge your position in a traditional futures market, when the settlement date is close to the expiry date, you have to move your position from the current contract to a forward contract. In other words, you have to close position in the current contract and open the same-sized contract in a forward contract.

One might wonder what the difference is between margin trading in the spot market and margin trading in the perpetual swap market since they both provide leverage and short direction. The first thing to remember is that you are trading a contract in the perpetual swap market. Especially for commodities like corn or oil, there is no need to worry about additional costs such as storage and transportation (known as carrying costs).

Contract For Difference

A contract for a difference (CFD) allows a trader to exchange the difference in the value of a financial product between the time the contract opens and closes without owning the actual underlying security. Therefore, when the contract expires, there is no need to deliver the underlying asset. You only need to settle the difference between the opening price and the current price. There may or may not be an expiry date, which depends on the issuer. If there is no expiry date, CFDs are very similar to perpetual swaps.

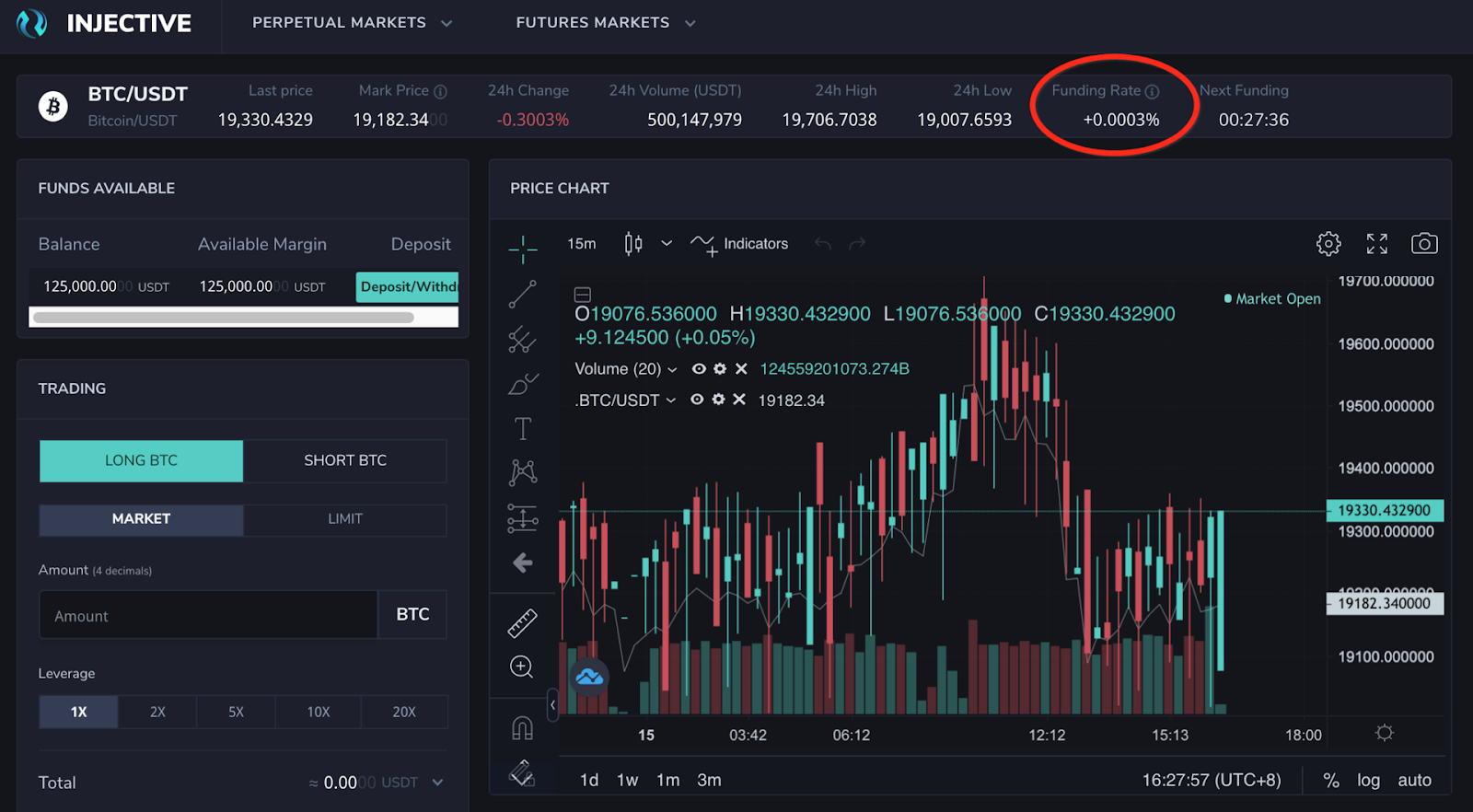

Funding Rate

The funding rate is used in conjunction with the spot index price (sometimes called mark price) to keep the contract in line with the underlying asset's actual value. The spot index price is the calculated broad market value of the underlying asset.

The funding rate is based upon the spot price. It works by forcing one side of the market to pay the counterparty if the contract's price strays from the spot index price. If the contract price is more than the index price (i.e., funding rate is positive), long positions will pay short positions at a rate determined by the amount of variance between the spot price and the current price of the futures contract. If the contract price is valued at less than the spot price, short positions pay the long positions (i.e., funding rate is negative), so the market is mostly kept equal.

Maintenance Margin and Margin Call

The maintenance margin is the minimum account balance you must maintain before the exchange forces you to deposit more funds or sell assets to pay down your loan. When this happens, it is known as a margin call. A margin call effectively demands you to add more money to your account or close out positions to bring your account back to the required level. If you do not meet the margin call, the exchange may close out any open positions to bring your account back up to the minimum value.

Trading Volume

One of the advantages of trading perpetual swaps is often the high trading volumes seen compared to the futures market and spot markets. Due to the high leverage available for trading, futures and perpetual swaps often have more trading volumes than the spot market.

Since there is an expiration date for the futures market, fundings are split into different zones like the weekly or quarterly futures market. However, for perpetual swaps, there is only one market where all funding will be gathered and concentrated so the trading volume tends to be higher as a result.

Closing Remarks

On Injective, users will be able to gain unrestricted access to markets such as perpetuals, spots, and futures. This will help to unlock a new paradigm in the world of trading moving forward.

About Injective

Injective is a lightning fast interoperable layer one blockchain optimized for building the premier Web3 finance applications. Injective provides developers with powerful plug-and-play modules for creating unmatched dApps. INJ is the native asset that powers Injective and its rapidly growing ecosystem. Injective is incubated by Binance and is backed by prominent investors such as Jump Crypto, Pantera and Mark Cuban.

Website | Telegram | Discord | Blog | Twitter | Youtube | Facebook | LinkedIn | Reddit | Instagram | Orbit Newsletter