One of the primary goals at Injective has always been to create a new financial paradigm that is wholly owned, operated, and governed by the community. A critical component of achieving this vision is to enable robust decentralized governance so that the vibrant Injective community can continue to spearhead new innovation for years to come.

The Injective Canary Chain is the first look into governance on the Injective mainnet. Governance can be used to propose new markets for listing on the Injective exchange, change the staking APY or any other parameter of the protocol as a whole. By doing so, Injective is able to pioneer a new economic system that is free, fair, and entirely governed by the global Injective community.

This article describes the nature of on-chain governance on the Injective Chain and provides a detailed overview of the lifecycle of a governance proposal.

Participate in Injective Governance here.

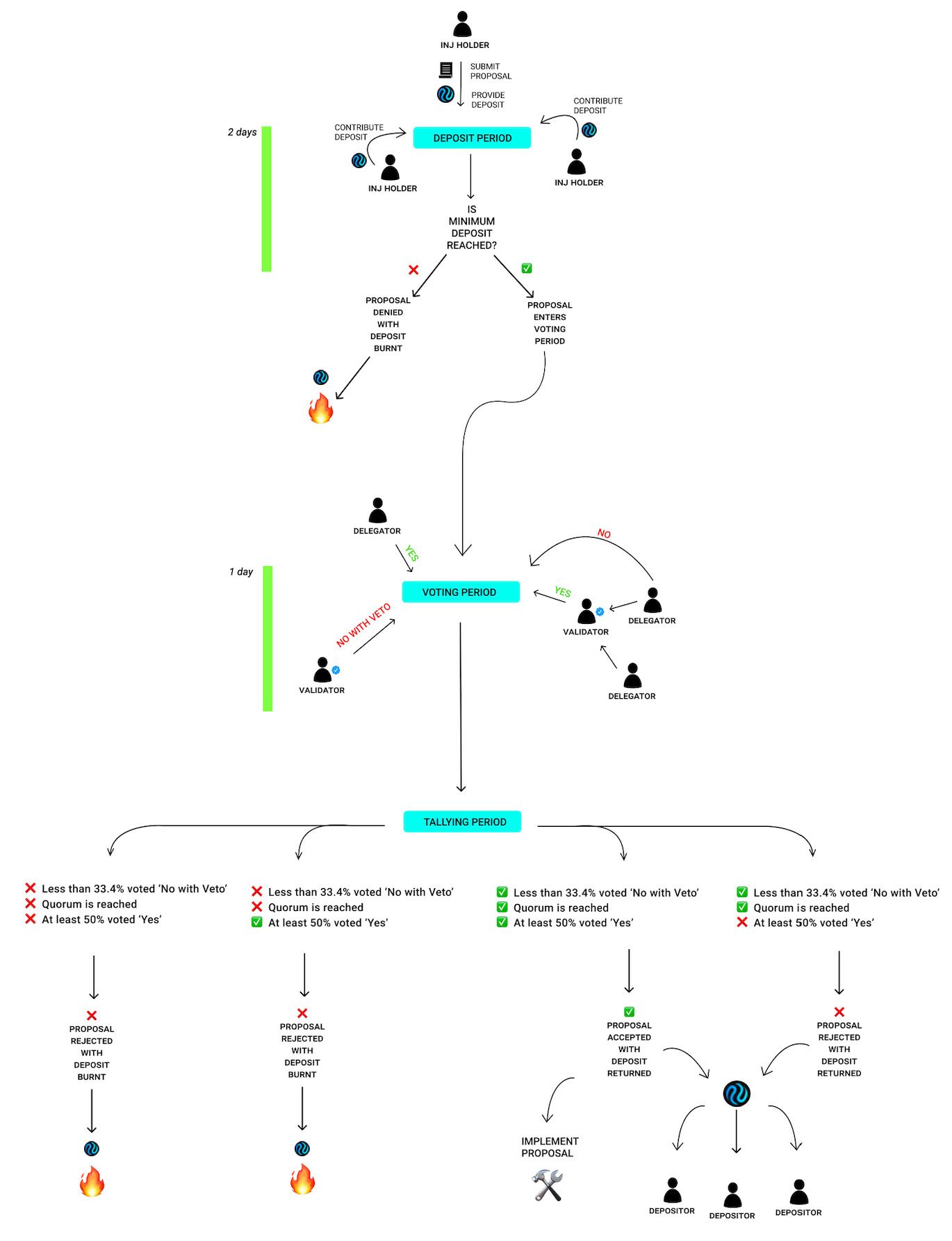

The Lifecycle of a Governance Proposal

Phase 1: Deposit Period

All on-chain governance actions start as proposals which can be submitted by any INJ holder. There are several types of proposals that can be submitted, which include but are not limited to the following:

- Spot/Derivative Market Creation Proposals

- Spot/Derivative Market Parameter Update Proposals

- Spot/Derivative Market Status Change Proposals

- Parameter Change Proposals for parameters on Injective’s native Exchange, Insurance, Oracle, Auction, and Peggy modules. In addition, proposals for the Cosmos-SDK Auth, Bank, Crisis, Distribution, Gov, Mint, Slashing, and Staking modules which are used by the Injective Chain.

- Plain Text Proposals

- Software Upgrade Proposals

To prevent spam, proposals must have a minimum deposit of 500 INJ in order to pass to the voting stage. All deposits are kept in escrow in the governance Module until the proposal is finalized (passed or rejected). If the proposer’s initial deposit covers the minimum deposit amount, the proposal will enter the voting phase immediately.

However, if the proposal submitter does not meet the 500 INJ minimum deposit, other token holders can increase the proposal’s deposit by sending a Deposit transaction until the maximum deposit period elapses.

If the minimum deposit amount is not reached by the time the maximum deposit period elapses, the proposal will be automatically rejected and the deposits are burned.

For efficiency, the maximum deposit period is 2 days, but can be changed via governance as all other parameters.

Phase 2: Voting Period

After the proposal passes the deposit period, the proposal enters the voting period via which INJ token holders can cast their vote. Unlike creating a proposal, only actively staked tokens are considered for voting, in which the weight a voter has is determined by the amount of INJ staked.

By default, if a delegator does not vote, it will inherit the vote of its validator, unless the delegator explicitly places a vote. If the delegator votes before its validator, it will not inherit from the validator’s vote, and if a delegator votes after its validator, it will override its validator vote with its own.

During the voting period, governance participants have 4 voting options:

- Yes

- No

- No with Veto

- Abstain

Voting a No With Veto counts as No but also adds a Veto vote. The Abstain option allows voters to signal that they do not intend to vote in favor or against the proposal but accept the result of the vote.

Phase 3: Tallying Period

There are several conditions that have to be satisfied for the voted proposal to be accepted:

- Quorum — More than 33.4% of the total staked tokens at the end of the voting period need to have participated in the vote.

- Threshold — At least 50% of votes that participated (and did not Abstain) need to have voted in favor of the proposal (a Yes vote).

- Veto — Less than 33.4% of the votes that participated (and did not Abstain) need to have vetoed the decision (a No with Veto vote).

If one of these requirements is not met by the end of the voting period, the proposal will be rejected.

If the proposal is approved or if it’s rejected but not vetoed, deposits will automatically be refunded to their respective depositors. When the proposal is vetoed by more than 1/3 of the voters by weight OR if the proposal does not reach quorum, the deposits for the proposal are burned.

Phase 4: Implementation Phase

If the proposal is accepted, it enters the implementation stage. For nearly all proposals (excluding Plaintext and Software Upgrade proposals), the implementation will be immediate and programmatically executed.

On Governance Participation Eligibility

Bonded INJ holders have the right to vote on proposals. Unbonded INJ holders do not have the right to participate in governance, but can still submit and deposit on proposals.

Note that a participant can be forbidden to vote on a proposal under a certain validator if:

- the participant bonded or unbonded INJ to said validator after the proposal entered its voting period

- the participant became a validator after a proposal entered its voting period.

This does not prevent a participant to vote with INJ bonded to other validators.

For example, if a participant bonded some INJ to validator A before a proposal entered its voting period and additionally bonded INJ to validator B after the proposal entered its voting period, only the vote under validator B will be forbidden.

How to Participate in Governance

The easiest way to get started with participating in the governance of the Injective Chain is to join the Injective Discord server or to join the Injective Governance Forum. You can participate in governance to list new markets here.

On the Injective mainnet, INJ stakers can test the governance lifecycle and earn rewards for doing so. It's mindblowing to witness the community enthusiasm to participate in governance, as hundreds of proposals surfaced during the Equinox testnet phase.

It's a historical moment in Injective's journey towards mainnet this year and everyone is invited to join in the pursuit of a more free and inclusive financial system through decentralization.

Additional Reading and References

- Injective Governance Dashboard: Link

- Injective Governance Launch: Spot Markets

About Injective

Injective is a lightning fast interoperable layer one blockchain optimized for building the premier Web3 finance applications. Injective provides developers with powerful plug-and-play modules for creating unmatched dApps. INJ is the native asset that powers Injective and its rapidly growing ecosystem. Injective is incubated by Binance and is backed by prominent investors such as Jump Crypto, Pantera and Mark Cuban.

Website | Telegram | Discord | Blog | Twitter | Youtube | Facebook | LinkedIn | Reddit | Instagram | Orbit Newsletter