Welcome to Injective’s jam-packed January update!

This month Injective launched the world’s first-ever decentralized stock and forex futures trading. This included the launch of assets such as Tesla, Amazon, GameStop, and Japanese Yen futures.

Injective also released a native e-learning platform, which will help to onboard new traders into the ecosystem moving forward. Along the way, Injective secured major collaborations with top tier projects globally, as well as acceptance into the highly coveted DeFi Alliance.

While the world of traditional finance continues to be mired in controversy and disarray as platforms such as Robinhood pose new restrictions on traders, Injective is continuing to unlock new frontiers. The Injective community has been working nonstop to carry out major product upgrades while ramping up the global network of supporters and integrating with industry titans.

Below you’ll find some of the major highlights from the past month.

January Highlights

- Injective released decentralized expiry futures trading

- Injective launched the world’s first-ever decentralized Tesla, Amazon, Twitter, and GameStop stock futures trading. This received press coverage from CoinDesk and a number of other major publications.

- Injective announced the world’s first-ever decentralized Forex futures trading while also adding in the Euro, Yen, Pound, Franc, and Ruble pairs

- The vision for Injective moving forward was published

- Injective was accepted into the DeFi Alliance

- Injective successfully ended the trading competition with over 1M trades processed.

- Injective collaborated with Fantom, Cobo Wallet, Plasma Pay, Alliance Block, Acala, and UniLend. Injective also launched cross-chain staking derivatives with Ramp DeFi and TomoChain

- Injective Labs CEO hosted a panel on lending protocols with AAVE, Yearn Finance, Placeholder, and Union Square Ventures. Injective Labs also hosted another panel on synthetic assets with Band Protocol and Terra

- Injective's educational platform called Injective Learn was launched alongside the new native Injective Blog

- Injective collaborated with Blockchain Education Network to accelerate growth. Injective also participated in AMAs with Oddgems and Hillrise Capital

1. Decentralized Expiry Futures Release

Injective started the year by launching decentralized expiry futures trading.

This is a monumental step towards the creation of a fully decentralized derivatives exchange. Now users can create not only crypto native futures markets but also a plethora of others that are not available elsewhere. This includes synthetic assets such as stocks and forex along with prediction markets as well.

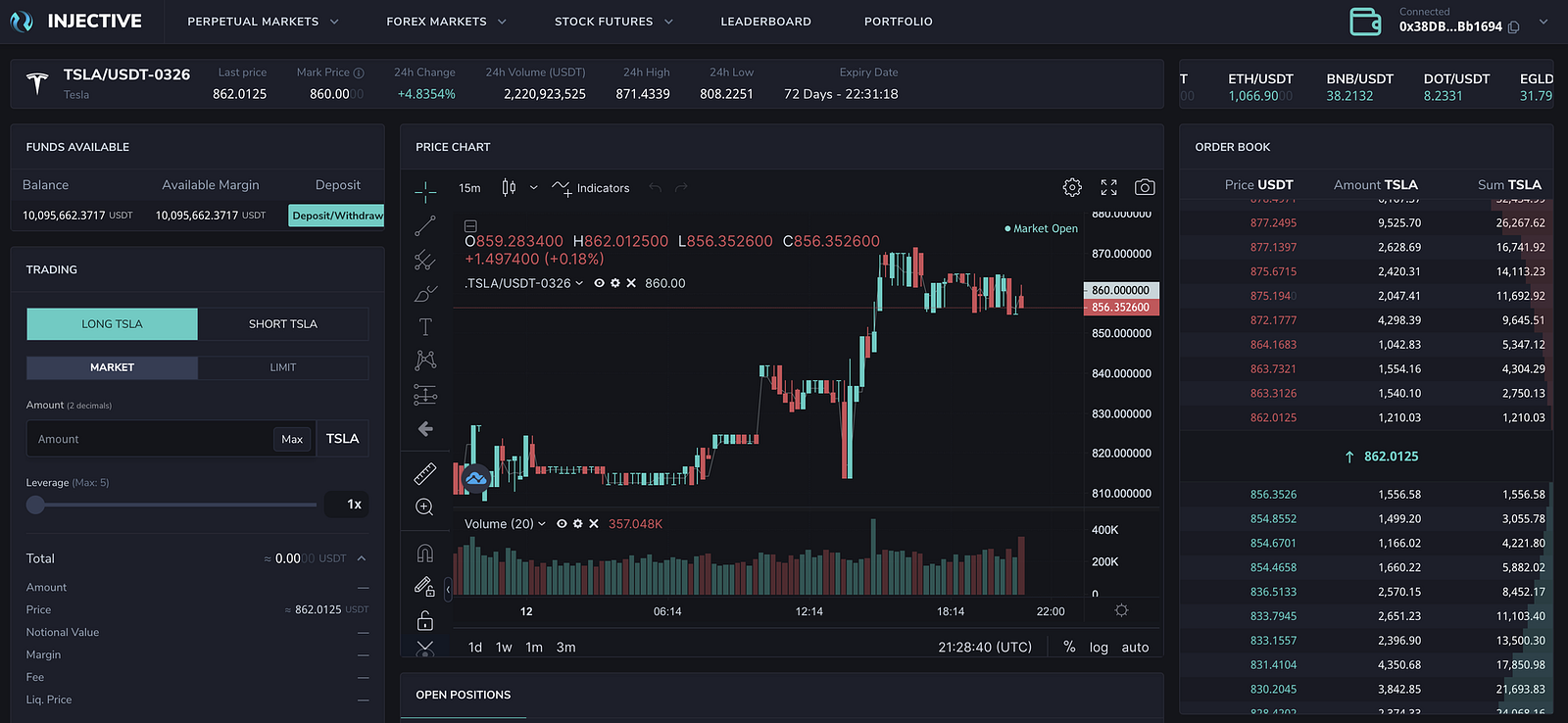

2. Injective launched a number of new stock futures markets including Tesla, Amazon and GameStop

Tesla was strategically chosen as the first futures market on Injective, on the heels of the company’s blockbuster year in 2020. This marks the first time in history that Tesla futures can be traded in an entirely decentralized setting. This received coverage on CoinDesk and a number of other major publications.

Tesla is by far the most traded stock by value on Wall Street, with $18 billion worth of its shares exchanged on average in each session over the past 12 months, easily beating Apple, in second place with average daily trades of $14 billion.

Injective also later added Twitter and Amazon stock futures trading.

Given the recent ban on trading of a number of stocks on Robinhood and major brokerages, Injective finally added GameStop stock futures trading.

3. Forex Futures Trading

Injective became the first exchange to launch fully decentralized forex futures trading. Until now, forex trading was largely restricted to traditional markets and centralized exchanges. This signals a true paradigm shift in this industry wherein control of such assets is given back to the masses. This will not only lead to a surge in traders who were previously unable to interact with such markets but also aid in democratizing the financial ecosystem as a whole.

This milestone received major media coverage, including on Cryptobriefing.

4. Injective’s Vision for a New Financial Paradigm

Injective released the vision moving forward.

Ever since its inception, Injective was built to create a platform that is fully decentralized, entirely permissionless, and exceptionally performant. This piece provides an overview of how Injective aims to rectify the salient issues that persist within crypto-native networks and the vision towards creating a truly innovative financial paradigm.

5. Injective Joined the DeFi Alliance

Injective was accepted into the latest cohort of the DeFi alliance. Past members include the likes of Synthetix and dYdX.

This will greatly help to strengthen the Injective network with liquidity providers as the community looks forward to mainnet in Q2.

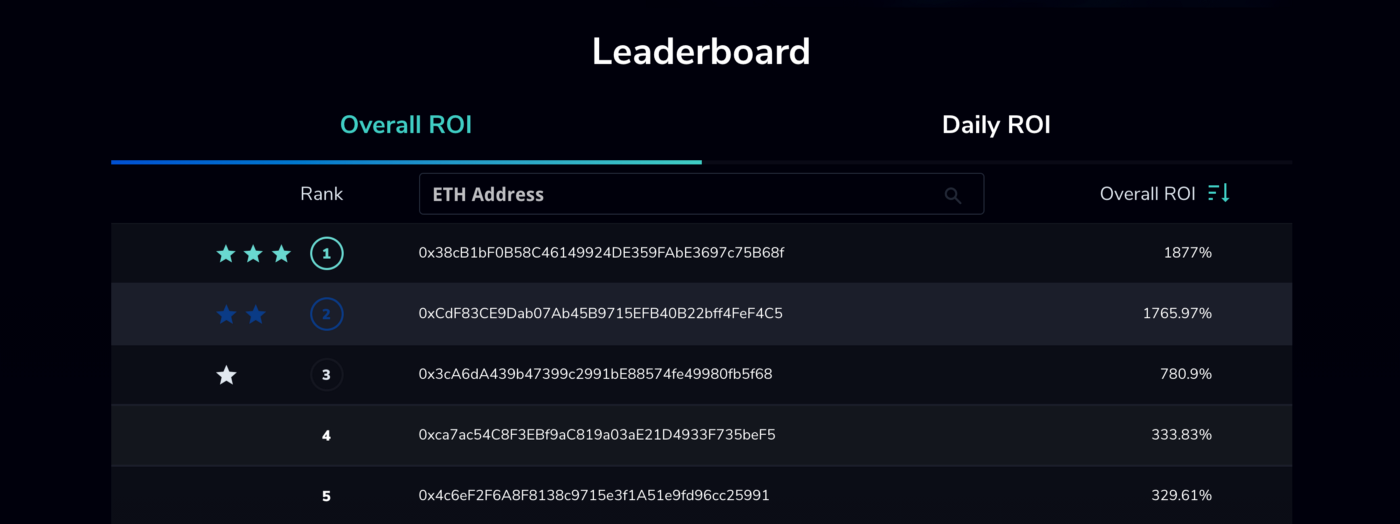

6. Injective Completed a Successful Trading Competition

Injective ended the trading competition with over 1M trades processed with users from across the globe.

7. Collaborations

This month saw a number of key collaborations added to the ever-growing Injective ecosystem.

Injective joined forces with Fantom to accelerate synthetic asset adoption.

Pioneering crypto wallet Cobo added INJ to their platform.

Injective is collaborating with Plasma Pay to enable fiat on-ramps for INJ.

Injective announced a partnership with Alliance Block, a decentralized, blockchain-agnostic layer-2 protocol. Together both parties will work to launch decentralized oil and gas futures, which constitute a multi-trillion dollar market in traditional finance. This is the first time DeFi users will be able to gain access to these assets.

Injective partnered with Acala, the decentralized financial hub of Polkadot, in order to bring its novel multi-collateral stablecoin (Acala Dollar) to the Injectivev derivatives exchange. This is a significant milestone for Injective and further bolsters collaboration with the Polkadot Network in order to showcase the limitless capabilities on Injective.

Injective linked up with UniLend, a decentralized money market, to unlock new yield farming opportunities.

Injective has begun developing cross-chain staking derivatives alongside collaborators Ramp DeFi and TomoChain. This means that in the coming months, users will be able to trade staking derivatives with leverage across multiple layer one protocols. The plan at Injective is to continue adding support for new stocks, indices, ETFs, and other unique derivatives.

8. Panels with Major Players within DeFi and Traditional Finance

Injective Labs hosted a number of major panels.

Lending Protocols and DeFi: Injective, Yearn Finance (YFI), AAVE, USV, and Placeholder

Synthetic Assets and Decentralized Stock Trading: Band Protocol, Terra, and Injective

9. Injective Learn

This month Injective Learn was officially launched, presenting a brand new blockchain education platform that publishes in-depth tutorials for all experience levels. The purpose of Injective Learn is to provide a comprehensive educational platform that equips learners to partake in everything that Injective has to offer.

Along with Injective Learn the new native Injective Blog was launched, where the majority of exclusive content and news will be published.

10. Community Building

Injective took part in a number of community-building initiatives this month in order to accelerate growth.

Injective collaborated with Blockchain Education Network (BEN) to onboard student traders worldwide to test and refine trading strategies on a robust, fee-less layer-2 DEX. The BEN team is now directing students to the quality trading education offered through Injective Learn.

Other community touch points included participating in AMAs with Oddgems, and Hillrise Capital.

Stay tuned for more updates in the coming weeks!

About Injective

Injective is a lightning fast interoperable layer one blockchain optimized for building the premier Web3 finance applications. Injective provides developers with powerful plug-and-play modules for creating unmatched dApps. INJ is the native asset that powers Injective and its rapidly growing ecosystem. Injective is incubated by Binance and is backed by prominent investors such as Jump Crypto, Pantera and Mark Cuban.

Website | Telegram | Discord | Blog | Twitter | Youtube | Facebook | LinkedIn | Reddit | Instagram | Orbit Newsletter