Injective is integrating six Chainlink price feeds to secure the decentralized derivatives exchange. The integration will include price feeds for ETH/USD, BTC/USD, DAI/USD, LINK/USD, USDT/ETH, and YFI/ETH, with the ability to quickly onboard additional feeds in the future as the product offering expands across more markets. These price feeds will enable users to create their own decentralized derivatives markets with total assurance that they will be settled by highly reliable and securely delivered data feeds.

Injective is designed to attract all types of traders and offers a diverse range of derivatives markets. Thus, Chainlink will now be able to reach new consumers and markets via the Injective DEX.

The goal of the Injective community has always been to become the best trading platform for retail traders, market makers, and investment institutions by developing useful financial tools for community networks. Injective operates on the Injective Chain, which will integrate with Cosmos IBC in the future. The trading platform is supported by verifiable delay functions (VDFs) that protect against front-running with lower-latency trading achieved through soft transaction cancellations.

Injective allows any individual to create and trade derivatives instruments with just a price feed to serve as an arbitrator. Since blockchains do not inherently create price feeds, or at best only represent a small fraction of the total trading activity, there is a pressing need for an oracle to connect Injective to aggregated off-chain data feeds. Not only do these price feeds need to be accurate, but they need to be delivered to the platform in a highly available and tamper-resistant manner to avoid any data manipulation concerns.

After significant research into oracle providers, Chainlink was selected as the first decentralized oracle solution that the Injective community will work with. Chainlink is the market-leading decentralized oracle network, with 50+ live Price Feed Data that users can quickly leverage on the platform today. These price feeds collectively secure over $3B in USD value across DeFi, including over 90% of the DeFi derivatives market. Chainlink price feeds have become the most widely adopted oracle network in DeFi because they provide users with strong guarantees around data quality, node security, and process transparency.

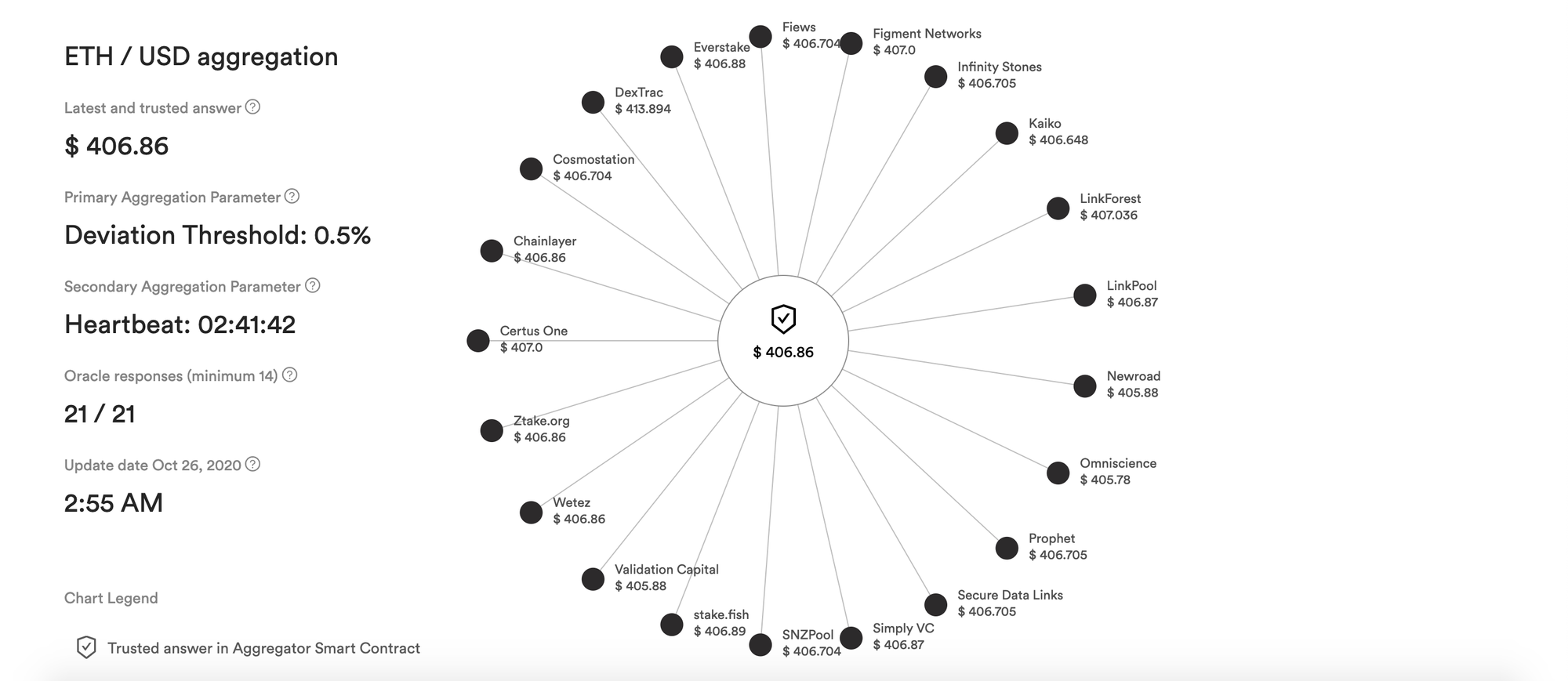

Chainlink’s Price Reference Data feeds are composed of an aggregation of independent, sybil resistant nodes operated by leading security and blockchain DevOps teams. Chainlink Nodes retrieve data from premium off-chain data aggregators with strong market coverage across all trading environments. Node responses are then aggregated to create a single, highly accurate, available, and manipulation-resistant on-chain price. All price feeds can be monitored in real-time by users via transparent visualizations, which show the current price, how the price is updated, the individual nodes that secure it, and much more.

“Chainlink has demonstrated its ability to deliver proven decentralized oracle infrastructure, high-quality data, and transparency to its DeFi ecosystem of users,” stated Eric Chen, CEO of Injective Protocol. “These are critical elements that we seek to bring to Injective Protocol in order to ensure it’s the most secure and reliable derivatives platform in the industry. We’re thrilled to use Chainlink to empower our users to quickly launch new and unique derivatives markets, and look forward to supporting additional price feeds as our user base grows.”

Chainlink’s price feeds are very easy to integrate; it’s essentially a plug-n-play solution with 50+ price feeds for cryptocurrency, FX, commodities, indices, and more already live. It’s also easy to build new price feeds not yet available, enabling Injective to easily scale to support increased demand. Finally, the community is exploring using the Chainlink Network as a gateway to make trading/market data generated on the platform available to other blockchain dApps.

“We look forward to helping Injective’s users create their own derivatives markets by providing them with secure and reliable price oracles used to accurately settle contracts. Our collaboration will allow Chainlink to expand and scale alongside Injective, reaching a diverse array of new derivative markets and users globally,” said Johann Eid, Chainlink Product Manager.

About Injective

Injective is a lightning fast interoperable layer one blockchain optimized for building the premier Web3 finance applications. Injective provides developers with powerful plug-and-play modules for creating unmatched dApps. INJ is the native asset that powers Injective and its rapidly growing ecosystem. Injective is incubated by Binance and is backed by prominent investors such as Jump Crypto, Pantera and Mark Cuban.

Website | Telegram | Discord | Blog | Twitter | Youtube | Facebook | LinkedIn | Reddit | Instagram | Orbit Newsletter