Solstice Pro officially launches today, bringing unrivaled institutional-grade products to the Injective DEX. Starting later today, Injective will provide access to a new institutional version of Solstice that is months ahead of the original schedule.

The community had been working in stealth for quite some time on UI and infrastructure upgrades that specifically cater to institutions since witnessing a massive lack of development in that arena to date.

This piece will delve into a few of the optimizations that have been carried out and how the Injective community aims to usher in a new era of institutional adoption for decentralized derivatives trading.

Background

The initial version of Solstice was released towards the end of November, which was met with an unprecedented level of interest from tens of thousands of users globally. The launch was soon covered by the likes of TechCrunch.

Over time key contributors within the community continued to add new asset classes to further demonstrate the true versatility of Injective. This included the trading of synthetic gold, which CoinTelegraph also covered. Later additions included the world’s first yield farming derivatives followed by the launch of the first ever decentralized stock futures trading which would allow users to soon trade markets such as Tesla and Google. Incredibly, all of this was achieved in under a month as community enthusiasm continued to swell.

But that's only the tip of the iceberg of all the work that was being done. From the earliest days, the project received backing from some of the largest institutional trading funds. The aim was to bring an accessible platform not only to crypto enthusiasts but also to institutional traders.

The community worked together to pool feedback across the network of institutional investors, market makers, and hedge funds. There was great enthusiasm for derivatives trading on crypto but these funds remain restricted by the underwhelming platforms available in the market today. Most exchanges in the market today either suffer from regulatory hurdles or do not possess the product sophistication needed to entice institutional interest.

The Injective community tackled each of these existing problems methodically and with precision. A number of iterations were built over the past few months in order to devise the proper tools needed to operate a DEX that could cater to both novice and professional traders. During this time a number of distinct parameters were optimized across the frontend and infrastructure to allow for a much more robust trading experience.

As a result, everyone can now have access to Solstice Pro, which provides an unmatched trading experience for everyone. Moreover, this launch serves as the first real step in garnering a significant level of institutional adoption for decentralized derivatives trading.

Solstice Pro

Here is an explanation of some of the more significant changes that accompany the launch of Solstice Pro.

Expiry Futures

Support has now been added for expiry futures.

Expiry futures form perhaps the foundation of derivatives trading within traditional markets. This is due to the inherent flexibility offered by expiry futures relative to perpetual contracts. While perpetual futures require significant liquidity for the underlying to be a viable product, expiry futures can be extremely versatile and dynamic, allowing for even more market innovations to occur on Injective. It is expected that event-specific products will be launched on Injective, allowing market creators to utilize expiry futures as a platform for traders and hedgers to speculate on a specific market event.

A good example would be an expiry futures for a newly launched token that settles after investor unlock, market makers can provide sufficient liquidity by capturing the underlying while vested investors can hedge their exposure at a much lower cost than perpetual futures.

Now traders can create and trade quarterly futures, binary options, along with countless other markets.

Extensive Trade History

The Injective platform now enables users to view past trades which provides new avenues for traders to analyze their trades and overall portfolio. This includes added support for trade history, position history, and deposit history.

This was achieved with additional backend changes to increase support for subgraph. This also includes minor performance optimizations.

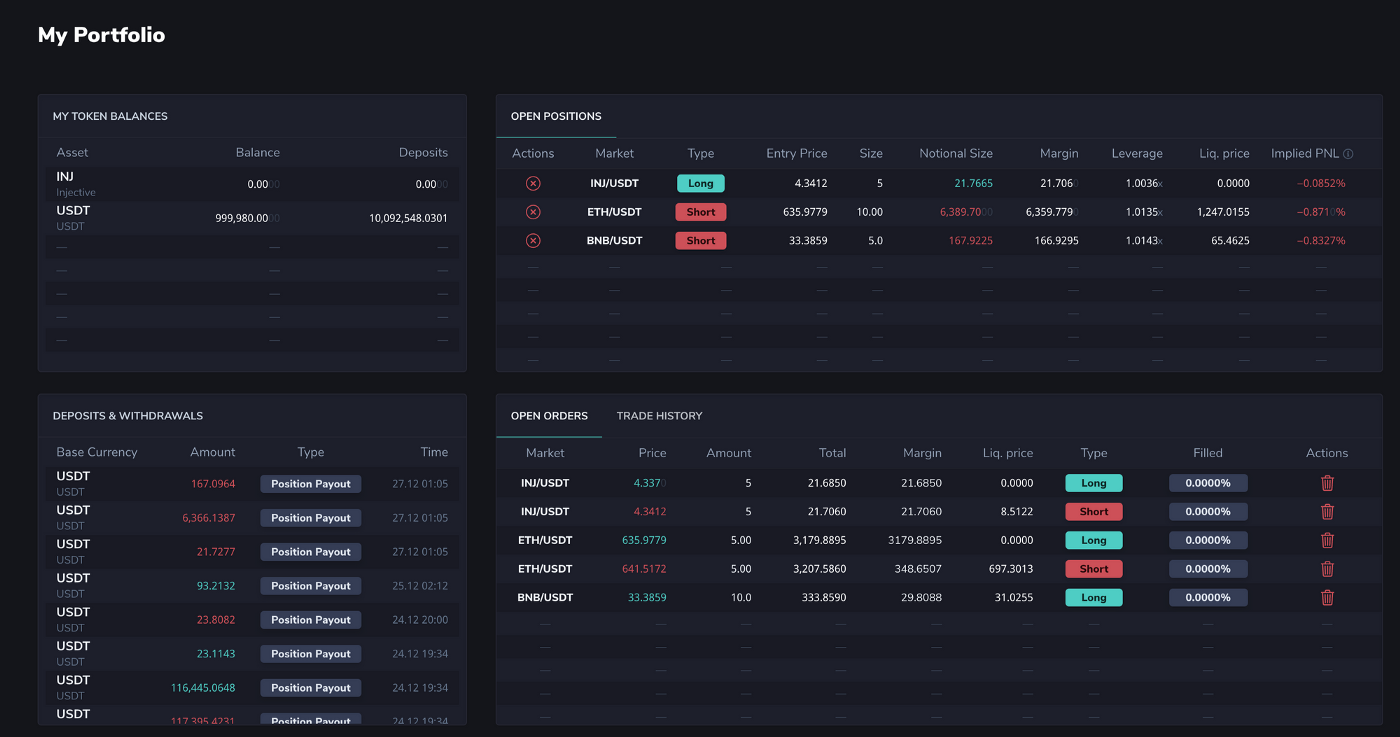

Dedicated Portfolio Pages

A dedicated portfolio page was one of the most highly requested features on Solstice. However, current DEXes in the market often do not include this which often leads to added frustrations for professional traders who need access to such information.

So on Solstice Pro, there is now a custom tab where traders can see their activity across all markets on Injective. This includes all token balances, deposits, withdrawals, open orders, open positions, and a complete trade history.

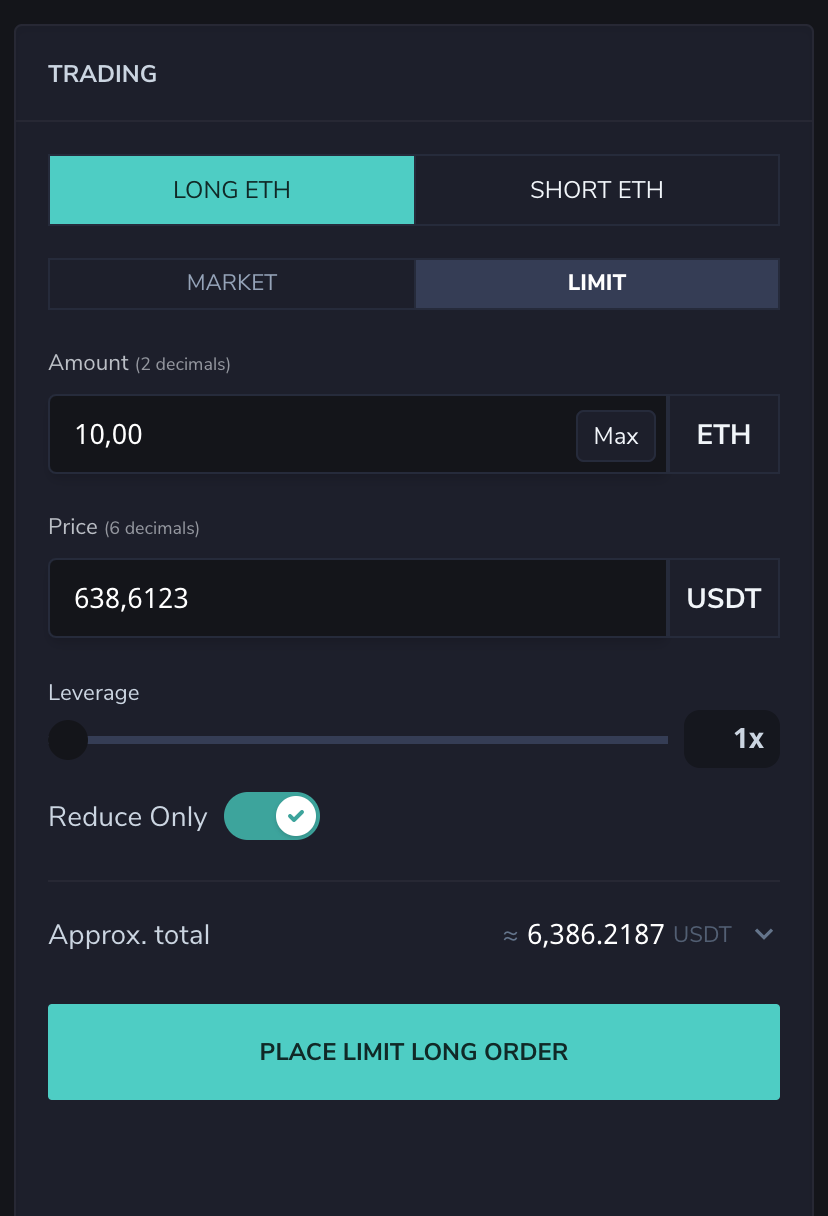

Reduce Only Orders

Reduce only orders have also been added.

This order type is used by traders who would like to reduce their current position size or to close position completely. This function is normally utilized by sophisticated traders who wish to automatically cancel or adjust any new position that may increase their initial position.

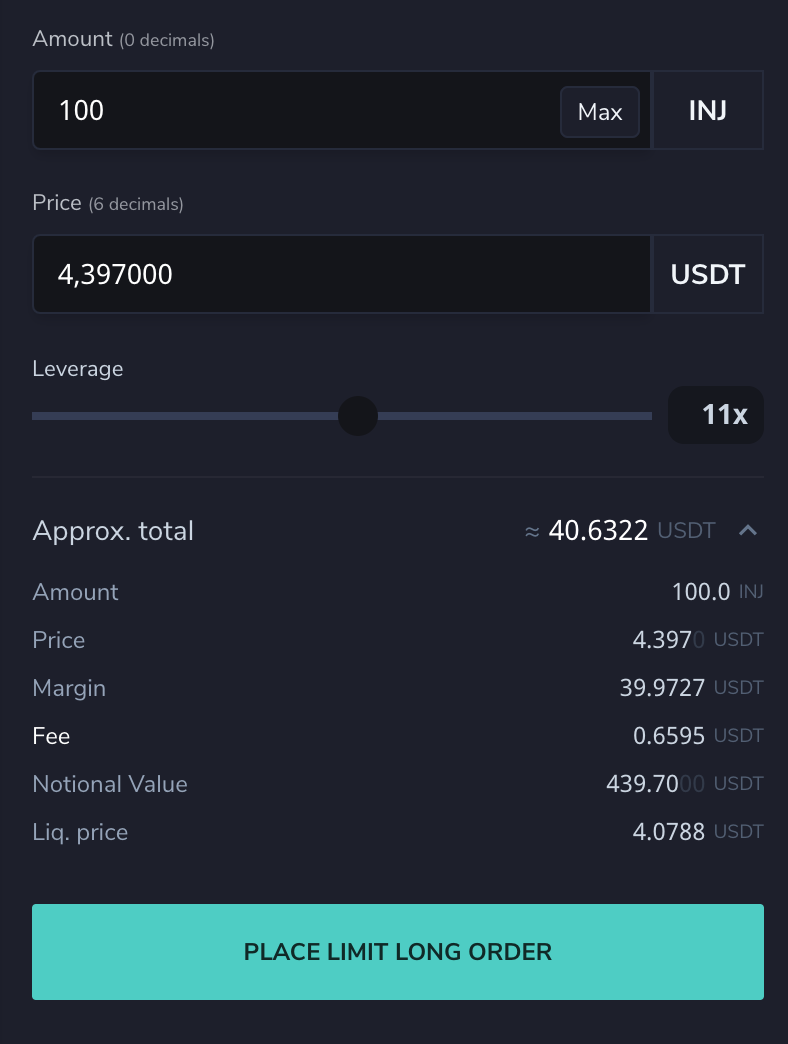

Optimized Leverage

The leverage slider now allows for higher levels of granularity with users being able to input specific leverage ratios. This means traders can now take part in more strategic hedging positions and being able manage their liquidation risk profiles appropriately.

Robust Orderbook

A number of indicators aid traders in being able to see their specific orders within the aggregate orderbook. This allows for additional ease when tracking individual orders.

In addition, additional volume indicators have been added on the right-hand size which helps to highlight the overall quantity of open orders for any given position.

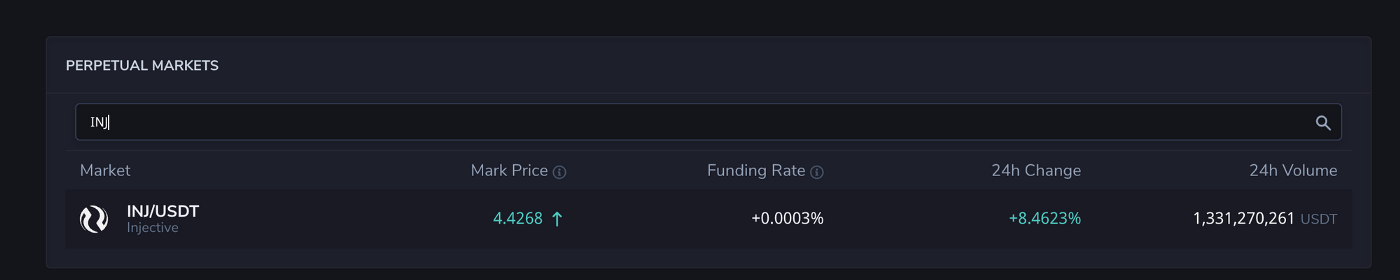

Upgraded Market Filtering

In the near future, Injective will serve as the core platform for any and all markets globally, so scrolling through every market would certainly be cumbersome.

As a result, dynamic market filtering has been added in, which will allow users to search for any market on Injective. This not only saves time but also provides new avenues to explore novel markets.

Users will now find any market at their fingertips. This becomes highly useful as new markets are added periodically on Injective.

Comprehensive Leaderboard

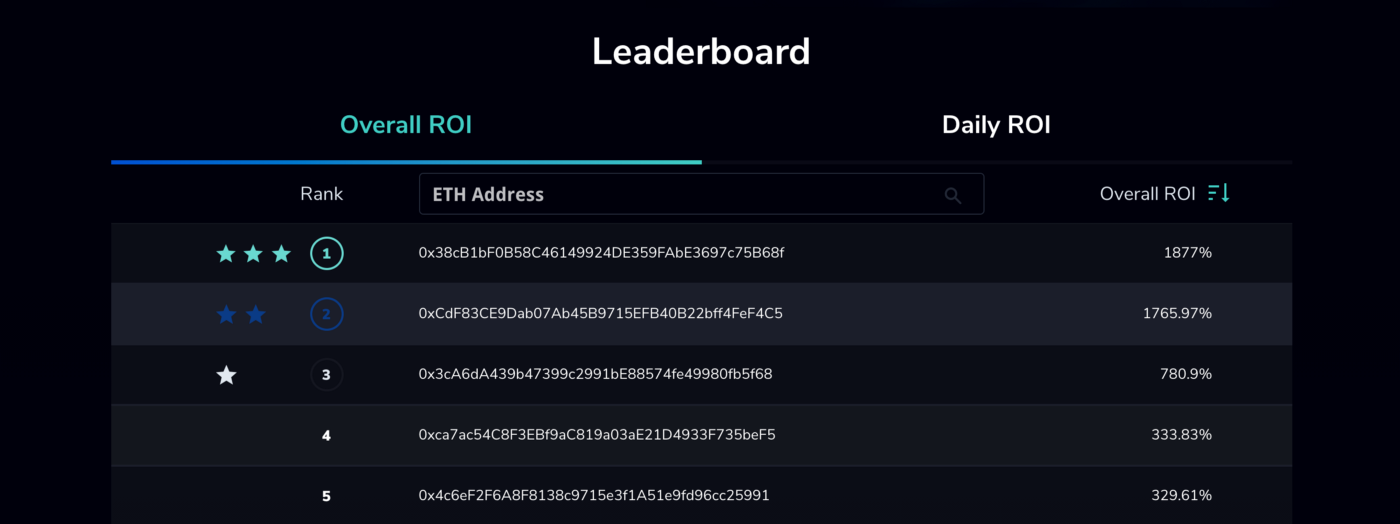

There is now a tab for a leaderboard that is able to rank traders based on their daily and overall ROI. This of course will be quite useful for the upcoming trading competition which allows users to see where they rank among other injective community members.

Composable Positions

A new DeFi primitive of composable derivative positions has been introduced, allowing users to compose their positions in other higher-level applications. This addition of permissionless composability is a powerful capability which can enable novel products to be built on top of Injective Protocol, such as structured products, tranches, and a wide array of variable/fixed rate instruments (the sky is the limit)! This new capability not only opens the door for creative experimentation for DeFi developers but also demonstrates the power of the decentralized platform, as no centralized exchange in the world currently supports composable positions.

Miscellaneous

End-to-end Dockerization and Service Orchestration

As a fully decentralized protocol, the aim is to decentralize the business model of exchange into a decentralized public utility. This will require open-sourcing every single infrastructure component to operate and support exchange, from the front-end exchange interface, back-end infrastructure, smart contracts, to orderbook liquidity.

An important step in accomplishing this is to minimize any technical barriers for users to participate in the network as a validator, relayer or exchange service provider. To this end, every component of the infrastructure has been containerized in preparation to allow anyone to frictionlessly participate in the Injective ecosystem.

A New Era in Decentralized Derivatives Trading

From its inception, Injective was built to offer a limitless trading experience. Solstice Pro offers the first truly decentralized trading experience for everyone, while simultaneously paving the way for real institutional adoption.

A number of new initiatives are already in the works that will further propel Injective to new heights.

About Injective

Injective is a lightning fast interoperable layer one blockchain optimized for building the premier Web3 finance applications. Injective provides developers with powerful plug-and-play modules for creating unmatched dApps. INJ is the native asset that powers Injective and its rapidly growing ecosystem. Injective is incubated by Binance and is backed by prominent investors such as Jump Crypto, Pantera and Mark Cuban.

Website | Telegram | Discord | Blog | Twitter | Youtube | Facebook | LinkedIn | Reddit | Instagram | Orbit Newsletter