The Injective Insurance Fund has been released. All users will be able to interact with the Insurance Fund shortly, which will serve as a key step for launching decentralized derivatives on Equinox.

This piece will cover the conceptual background of the role of an insurance fund in derivatives exchange as well as the unique features of the Injective Insurance Fund.

What is an Insurance Fund?

In order to understand the function of an insurance fund, one must first understand the margin system used for leveraged derivatives trading. On a high level, leverage allows traders to enter into derivatives positions whose value is much higher than the collateral posted to fund the position.

As a result, it is possible that the losing party on a trade cannot afford to pay the winning party if they run out of margin, i.e. the position becomes bankrupt. When this occurs, the trader’s position is liquidated and a new trader takes over the position. In the event that the new trader takes over the position at a worse price than the bankruptcy liquidation price of the position, the insurance fund is utilized to cover the resulting deficit.

To understand this concept concretely, consider the following example.

The Liquidation System Explained

Suppose the price of ETH is $4,000. Alice enters into a long position of 1 ETH using $400 of collateral (10x leverage) and Bob enters into a corresponding short position of 1 ETH using $2000 of collateral (2x leverage). Suppose then that the price of ETH falls by 10%, i.e. to $3600 which is exactly the bankruptcy price of Alice’s position. The bankruptcy price is the point at which Alice’s position becomes worthless. At $3600, Bob’s short position will have a profit of $400 while Alice’s long position will have a loss of $400 (the entirety of her position equity).

Clearly, if the price of ETH falls even $1 more, Alice’s position will have gone beyond bankruptcy and there would no longer be sufficient funds to pay out the full extent of Bob’s profits.

In order to prevent such a scenario, Alice’s position is subject to liquidation (forcible closure of a position) once it no longer satisfies a minimum maintenance margin requirement. Maintenance margin is the minimum amount of funds that an investor must maintain in the margin account. The maintenance margin ratio imposes a stricter margin requirement that positions must satisfy in order to avoid liquidation. In Alice’s case, the maintenance margin requirement would result in her position being liquidated at a higher price (e.g. $3,680), thus providing a buffer to prevent the position being liquidated at a price below the bankruptcy price.

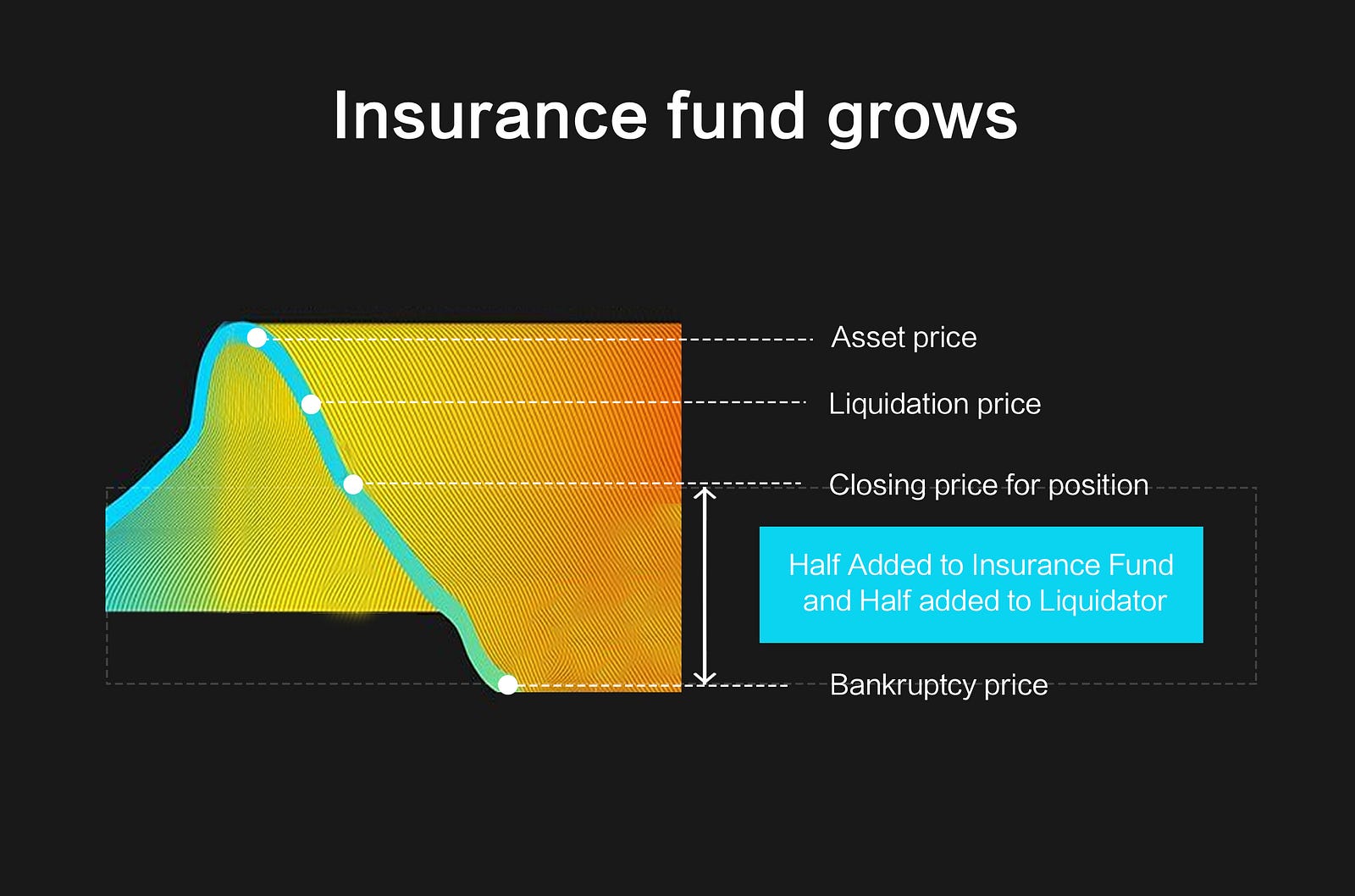

In most typical trading scenarios, this buffer will allow for the position to be liquidated at a better price than the bankruptcy price. In such cases, any remaining position equity ($80 in Alice’s example of a liquidation at $3680) is split equally between the liquidator and the insurance fund ($40 to each party). As a result, the size of the insurance fund will grow.

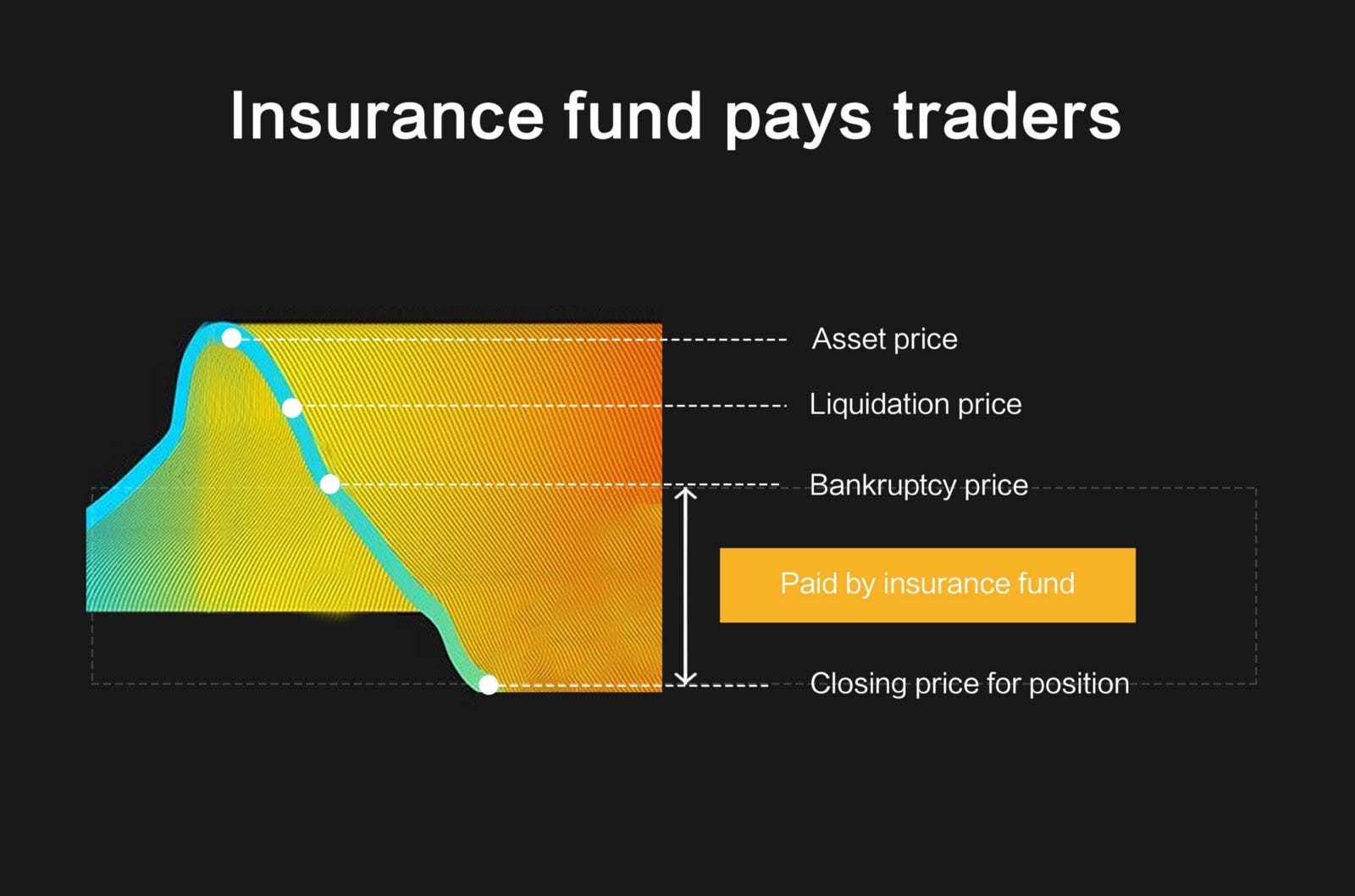

However, given the volatile nature of crypto trading, it is possible that the closing price falls below a position’s bankruptcy price. In such a case, the insurance fund is utilized to cover the deficit. For example, if Alice’s position is closed at $3500, $100 is withdrawn from the insurance fund to restore solvency to the system since her bankruptcy price was $3,600.

So to summarize the example above: Alice’s position is worth zero at her bankruptcy price. Her position can be liquidated by the exchange at her liquidation price. However, the price at which the exchange is actually able to sell is referred to as the closing price.

The Injective Insurance Fund

On Injective Protocol, each derivative market has its own unique insurance fund which has its own specific capitalization.

Before someone can trade on a derivative market, an insurance fund must be created for the market. Insurance funds are initially capitalized by independent underwriters who underwrite the risk of the insurance fund by means of staking the collateral token of the derivative market (e.g. USDT). Then, as trades occur on the market, the insurance fund can grow or shrink depending on the liquidation activity on that particular derivative market.

This process is illustrated by the examples below for liquidating a long position.

Growing an Insurance Fund

The insurance fund grows when a position is liquidated at a price that is HIGHER than the bankruptcy price.

Utilizing an Insurance Fund

The reverse situation is also possible of course. If the closing price is LOWER than the bankruptcy price, funds are withdrawn from the insurance fund.

Insurance Fund Staking

Unlike most exchanges, the insurance fund on Injective is market-specific. That is, there is no common pool of Insurance capital collected, but rather a new fund exists for each derivative market launched on Injective. This way, risk for underwriting insurance is isolated to each individual market.

When a user underwrites insurance for a derivative market, he stakes the collateral currency for that market and in turn receives insurance pool tokens specific to the market. These pool tokens represent pro-rata (proportional) ownership of the insurance fund. Thus, as an insurance fund grows from liquidation proceeds, the insurance fund stakers gain profit from the increase in value of their stake of the insurance fund.

In general, riskier markets tend to have higher staking reward rates in order to compensate users for taking on higher levels of risk.

Let’s assume that two separate insurance funds exist. The first insurance fund is for the BTC/USDT pair and the second insurance fund is for the SHIB/USDT pair. BTC is considered to be less risky relative to SHIBA so the risk profile of SHIBA would be higher. As a result, the staking rewards on SHIBA will likely be higher to compensate users for the higher levels of risk.

Moving Forward

Community-owned insurance funds are a critical component of a fully decentralized exchange protocol.

Looking ahead, now that the conceptual background has been provided, community members will collaborate on a series of practical guides for staking on insurance funds on Injective as well as participating in derivative market governance.

About Injective

Injective is a lightning fast interoperable layer one blockchain optimized for building the premier Web3 finance applications. Injective provides developers with powerful plug-and-play modules for creating unmatched dApps. INJ is the native asset that powers Injective and its rapidly growing ecosystem. Injective is incubated by Binance and is backed by prominent investors such as Jump Crypto, Pantera and Mark Cuban.

Website | Telegram | Discord | Blog | Twitter | Youtube | Facebook | LinkedIn | Reddit | Instagram | Orbit Newsletter